Expansion of Debt Warehousing Scheme for directors / employees with material interest impacted by S997A TCA

The Institute has raised concerns with Revenue at TALC regarding the interaction of section 997A TCA 1997 with the Debt Warehousing Scheme for employers’ COVID-19 related PAYE liabilities. In particular, we have sought a practical approach to situations where a Form 11 is filed for an individual who is subject to section 997A but does not meet the conditions to qualify for income tax debt warehousing. Otherwise, an income tax liability potentially could immediately crystalise on filing the return where that individual’s PAYE is warehoused by their employer. In addition, the Institute made representations on this issue to the Minister for Finance, Paschal Donohoe T.D, seeking a change to the legislation in our Pre-Budget and Pre-Finance Bill submissions.

The Budget 2022 Tax Policy Changes document, published on 12 October, notes that the Debt Warehousing Scheme will be expanded to allow self-assessed income taxpayers with employment income who have a material interest in their employer company, to warehouse tax liabilities relating to their Schedule E income from that company. The legislative provisions are expected to be included in Finance Bill 2021, due for publication on Thursday, 21 October.

Revenue has provided the Institute with the following clarification on operational aspects of the measure, as outlined below.

I refer to your representations at TALC regarding the section 997A Taxes Consolidation Act 1997 (TCA) issues impacting certain directors / employees who have a “material interest” in the company that pay their emoluments, and who are not entitled to a credit for the tax deducted from their remuneration under the PAYE system but not remitted to Revenue, as a consequence of their employer company availing of debt warehousing for PAYE (Employer) liabilities.

In yesterday’s Budget publication, the Department of Finance has outlined the intention to allow self-assessed income taxpayers with employment income who have a material interest in their employer company to warehouse income tax liabilities relating to their Schedule E income in these circumstances. Please note this is subject to the enactment of the Finance Bill.

In this regard:

- where a director / employee has a “material interest” in the company that pays their emoluments, and

- section 997A TCA means the director / employee is not entitled to a credit for the tax deducted due to the company warehousing its PAYE (Employer) liabilities, and

- the director/employee does not satisfy the 25% reduction of income threshold to avail of income tax debt warehousing,

the director / employee may avail of debt warehousing only for their Schedule E (PAYE) liability which has been warehoused by the employer company. The non-Schedule E liability must be paid when filing the income tax return.

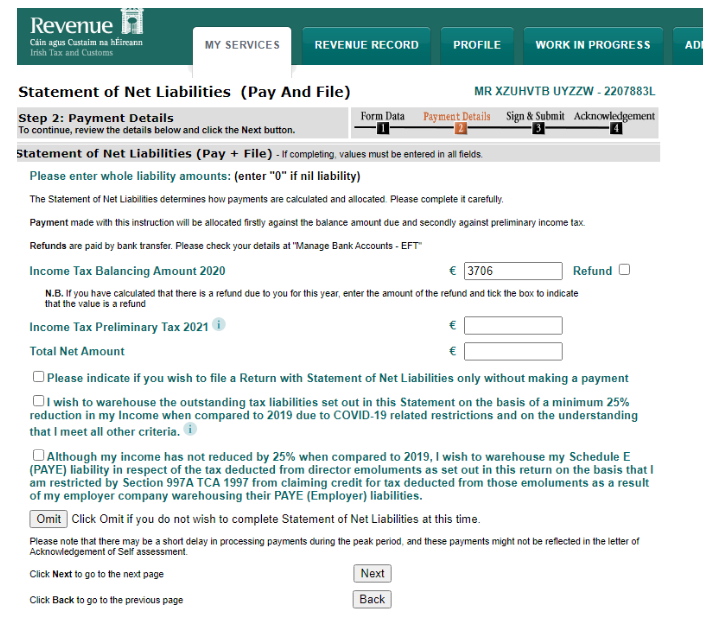

Revenue has updated the Statement of Net Liabilities screen to include a new tick box declaration (as outlined below). When completing the Statement of Net Liabilities screen, a director / employee who satisfies the above requirements and wishes to warehouse their Schedule E liability only, may tick the relevant declaration to avail of debt warehousing for their Schedule E liability.

Although my income has not reduced by 25% when compared to 2019, I wish to warehouse my Schedule E (PAYE) liability in respect of the tax deducted from director emoluments as set out in this return on the basis that I am restricted by Section 997A TCA 1997 from claiming credit for tax deducted from those emoluments as a result of my employer company warehousing their PAYE (Employer) liabilities.

|

Revenue has confirmed to us that taxpayers availing of warehousing for their Schedule E (PAYE) liability may avail of the extended filing date of 17 November 2021, where the return is filed via ROS and the non-Schedule E liability payment is made via ROS on or before 17 November 2021.