This bulletin covers the new employee-focused developments on Revenue’s myAccount service. PAYE taxpayers can now access details of their total pay and statutory deductions for 2019 and view Revenue’s preliminary calculation of their tax position for the year. We explain below some of the new terminology and documentation, address basic questions employees may have on these developments and include some relevant screenshots from myAccount.

Terminology and Documentation – What you need to know

The Employment Detail Summary is the official record of an employee’s pay and statutory deductions for the year. It replaces the P60 for 2019 and subsequent years. Financial institutions, the Health Service Executive and other third parties who may typically have sought a P60 are aware of the new document.

The Preliminary End of Year Statement is Revenue’s provisional calculation of a PAYE taxpayer’s income tax and USC liability for 2019. This calculation is based on the pay and statutory deductions submitted by employers throughout 2019. This preliminary calculation may show that an employee’s tax and USC is balanced, the employee is due a refund or may have underpaid tax and/or USC.

The Statement of Liability replaces the (P21) End of Year Statement. It provides details of an employee’s total income, tax credits, tax and USC deducted, and any balance of income tax/USC outstanding or refundable for 2019.

Basic Questions

1. How do I access a summary of my pay and statutory deductions for 2019?

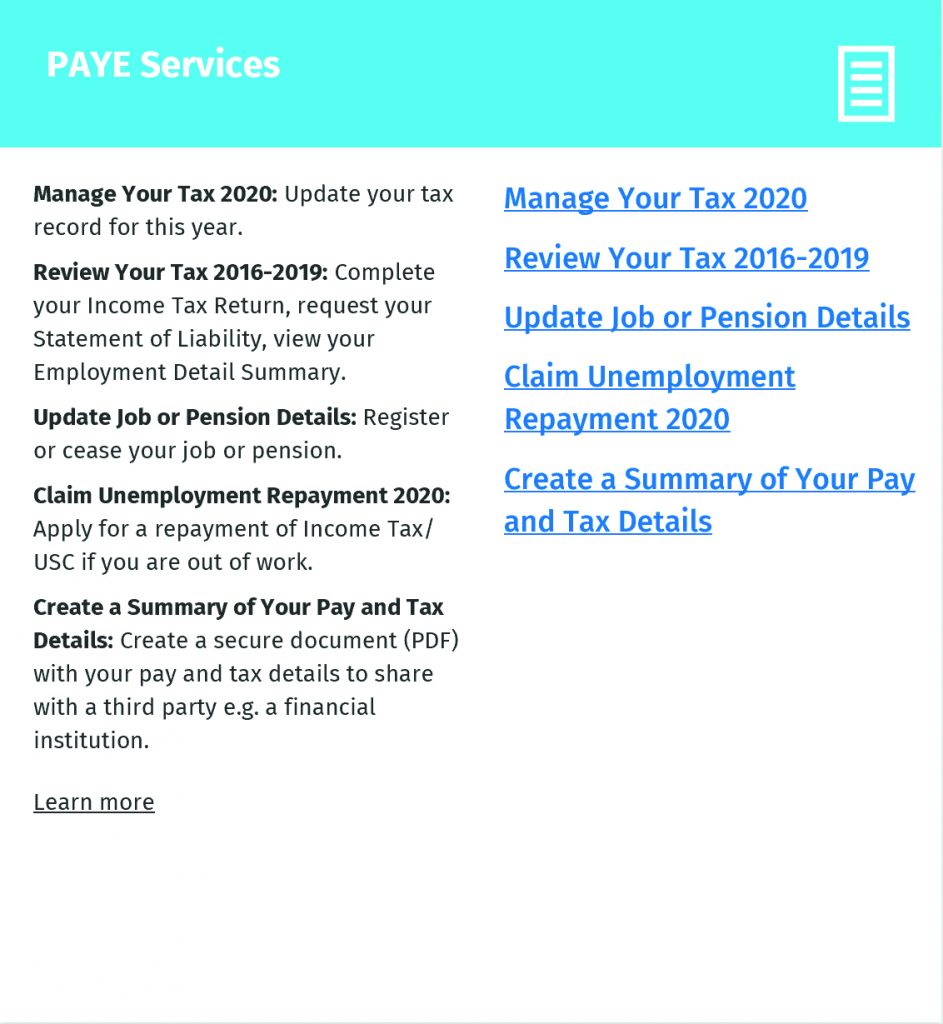

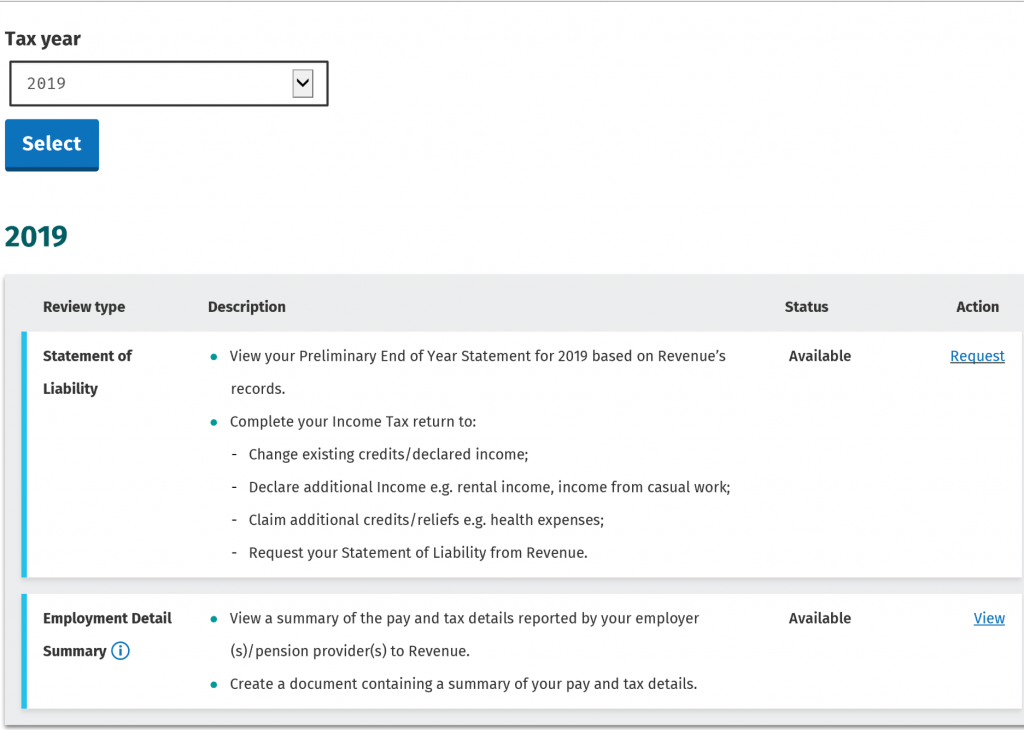

You can access the record of your pay and statutory deductions for 2019 in the Employment Detail Summary under “Review Your Tax 2016 – 2019” in the PAYE Services screen in myAccount. This summary can be downloaded or printed for your own records and provided to third parties as proof of income.

2. What should I do when I access my Employment Detail Summary for 2019?

You should check the information on your Employment Detail Summary is correct. For example, check that it reflects your correct address, total pay, number of weeks’ pay received, jobs held, and pensions received in 2019. It also includes your PRSI contributions. If any of the details appear to be incorrect this should be raised with your employer (or pension provider), in the first instance.

3. How can I check if I may be due a tax refund for 2019?

The Preliminary End of Year Statement will show whether you have underpaid, overpaid or paid the correct amount of income tax and USC for 2019, according to the information on Revenue’s records. You can view this preliminary calculation by requesting a Statement of Liability for 2019, under “Review Your Tax 2016-2019” in PAYE Services.

4. My Preliminary End of Year Statement indicates that I’m due a tax refund for 2019. Will this refund issue automatically?

The refund will not issue automatically as it is only Revenue’s preliminary calculation of your tax position, based on the information on Revenue’s records. You will need to submit an Income Tax Return for 2019, that includes your total income, allowable deductions and tax credits for 2019 so that Revenue has full information on your tax position.

You will be prompted to submit an Income Tax Return on myAccount. This return will be pre-populated with the information Revenue has on record for 2019. You should check that this information is correct and complete, and you should include all relevant income, tax credits and entitlements for the year, for example, any claim for tax relief on health expenses.

Once you have filed your Income Tax Return and it has been processed by Revenue, you will receive a Statement of Liability and any refund due in relation to 2019.

5. How will my refund be paid?

The refund will be paid directly into your nominated bank account if you provide these details to Revenue via the “myProfile” section in myAccount. Otherwise, you will receive a cheque by post. You can verify that Revenue has your correct address by reviewing this information on your Employment Detail Summary or in “myProfile”.

6. The Preliminary End of Year Statement indicates that I underpaid tax for 2019. What happens next?

If the Preliminary End of Year Statement shows an underpayment, you should submit an Income Tax Return for 2019 (via myAccount). This return should reflect all the relevant income, tax credit claims and entitlements for 2019, so Revenue has all the information relevant to your 2019 tax position.

Your Statement of Liability will issue once your Income Tax Return has been processed. It will detail how any underpayment will be recovered, for example, by adjusting your tax credits and standard rate cut-off point to spread out the recovery of any underpayment in a future tax year(s).

Over the coming months, Revenue will write to taxpayers who have underpaid tax according to Revenue’s preliminary calculation, to ask them to complete an Income Tax Return for 2019. If the taxpayer does not file a return, Revenue will write to the taxpayer again to advise them how Revenue intends to recover the underpayment.

7. Revenue’s Preliminary End of Year Statement indicates that I paid the correct amount of tax, do I need to take any further action?

If Revenue’s preliminary calculation indicates that the correct amount of tax was paid no action is required unless you are aware that the information on Revenue’s records is incorrect or incomplete or you require a Statement of Liability for 2019, for example, to support a mortgage application.

If you want to claim additional tax credits or reliefs for 2019 or you received additional taxable income during the year, you will need to submit an Income Tax Return for 2019.

8. I am unable to use online services – how can I obtain proof of my 2019 pay and statutory deductions and determine if I’m due a refund?

If you are unable to use online services, you should contact Revenue’s National PAYE Helpline for assistance on 01 738 3636. If you may be due a refund for 2019, then Revenue will post you an Income Tax Return for completion.

9. How do I check if I am due a PAYE/USC refund for earlier years?

You can review your tax position for 2016, 2017 and 2018 in the PAYE Services screen in myAccount. You will need to submit an Income Tax Return for these years if you received additional taxable income or wish to claim any additional tax credits or reliefs.

If you don’t need to make any amendments to prior tax years but you wish to check your tax position, you can request a Statement of Liability for 2016, 2017 and 2018.

10. What else can I do on myAccount?

Revenue added a number of new features to myAccount over the last year including:

- The facility for employees to view and print details of the pay and statutory deductions reported by their employers each pay date during the year.

- The option to create a summary of pay and tax information that can be shared with a third party, for example, a financial institution. This summary, which is password-protected can be tailored to include:

- Pay and tax for the year to date

- Up to three months current-year payroll details

- Statement of Liability for the previous four years.

- The option to divide tax credits between multiple jobs. If you have a second job or a job and a private pension you may wish to divide your tax credits and standard rate cut-off point between jobs.

- The ability to submit an unemployment repayment claim online. If you become unemployed during a tax year, you may qualify for a tax refund. You can make a claim for unemployment repayments through PAYE Services in myAccount.

Revenue Information Resources

Revenue has information resources to help PAYE taxpayers understand the new developments and their tax credits and entitlements. These include:

- PAYE Customers – End of Year Process

- PAYE Services: Manage Your Tax

- Personal Tax Credits, Reliefs and Exemptions

- 2020 Tax Credit Certificates

- How to register for myAccount

Share this

Share this  Share this

Share this  Share this

Share this